check how much monthly salary is taxed

19c for every dollar between 18201 - 0. Use the simple monthly tax calculator or switch to the advanced monthly tax calculator to review NIS payments and income tax deductions for 2022.

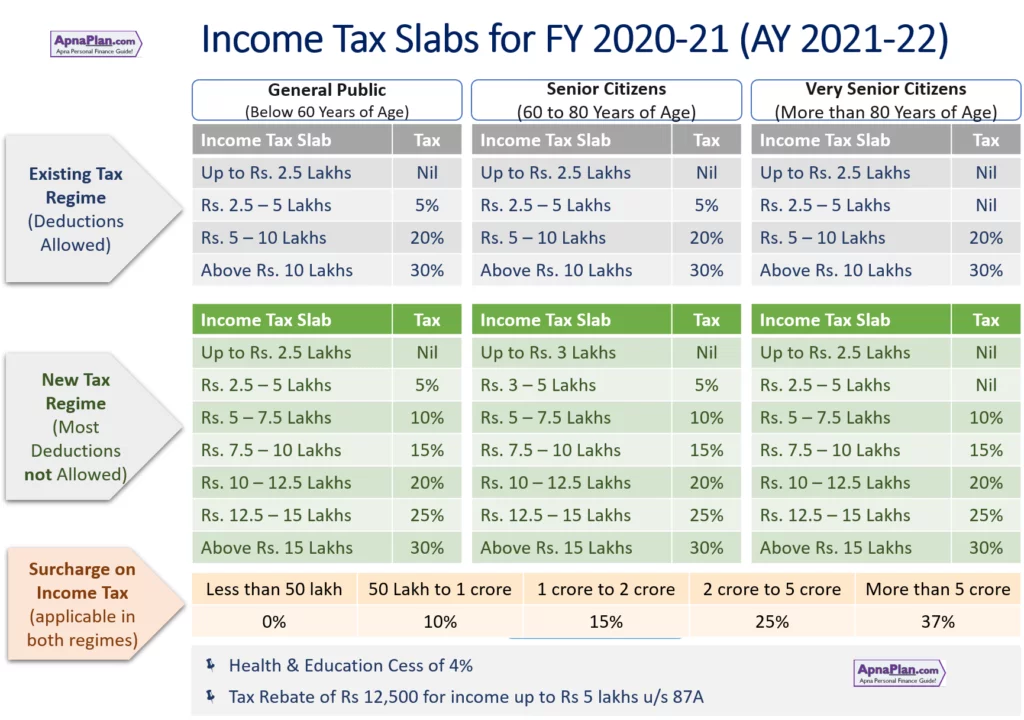

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Our salary calculator builds upon our comprehensive calculation system to provide you with an accurate breakdown of your salary by factoring income taxes national insurance and other deductions such as student loans and pensions.

. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. FICA taxes consist of Social Security and Medicare taxes. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket.

Income tax is the tax you pay on your income. UK Monthly Income Tax Calculator. The PaycheckCity salary calculator will do the calculating for you.

325c for every dollar between - 0. Your average tax rate is 222 and your marginal tax rate is 361. This tells you your take-home pay if you do not have.

Unlike our salary calculator where your salary calculation results are updated in one shot here you just need to enter or slide the top gross income stick and immediately you will see the total tax. Using this income tax calculator United Kingdom you can estimate how much tax you will owe if you earn 100000 each year. It can also be used to help fill steps 3 and 4 of a W-4 form.

This number is the gross pay per pay period. This calculator is intended for use by US. That 14 is called your effective tax.

However theyre not the only factors that count when calculating your paycheck. Your Monthly tax calculation split into amounts per year month week and daily rates. The calculation is based on the 2021 tax brackets and the new W-4 which in.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. This is the most advanced income tax calculator providing a visual breakdown of how your salary is broken up for tax and other deduction purposes. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022.

That means that your net pay will be 42787 per year or 3566 per month. No tax on income between 1 - 18200. US Tax Calculation for 2022 Tax Year.

Your net pay for a year will be 54832 or 4569 per month or 54500 annually. For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. For 2021 employees will pay 62 in Social Security on the first 142800 of wages.

Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. Here is what you can calculate with the Monthly Tax Calculator. If you earn over 200000 youll also pay a 09 Medicare surtax.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Given that the first tax bracket is 10 you will pay 10 tax on 9950 of your income. Income Tax is levied on a person who was in India for 182 days during the previous tax year or the person who was in India for at least 60 days during the previous tax year and for at least 365 days during the preceding 4 years will be taxed.

Given that the second tax bracket is 12 once we have taken the previously taxes 9950 away from 27450 we are left with a total taxable amount of 17500. This comes to 995. Individuals on incomes below 18200 are also entitled.

This tax calculation is based on an annual salary of 300000 when filing an annual income tax return in Virginia. Your employer matches the 62 Social Security tax and the 145 Medicare tax in order to make up the full FICA taxes requirements. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

Your personal salary and tax calculations see the table below for a full breakdown and analysis of your salary and tax commitments for 2022. You can calculate your Monthly take home pay based of your Monthly gross income Education Tax NIS and income tax for 202223. In other words your salary will be 66693 per year or 5558 on a monthly basis.

A new addition is the ability to compare two salaries side by side to see the. How Your Paycheck Works. 2021 federal income tax brackets Tax rate Taxable income bracket Tax owed 10 0 to 19900 10 of taxable income 12 19901 to 81050 1990 plus 12 of the amount over 19900 22 81051 to 172750 9328 plus 22 of the amount over 81050 24 172751 to 329850 29502 plus 24 of the amount over 172750 Jan 4 2022.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Dont want to calculate this by hand. The Monthly Tax Calculator is our most comprehensive payroll associated tax and deductions calculator from our suite of UK tax calculators.

We provide tax and finance information and calculators in support of this tax calculator. Among those who have a salary of 75000 per year you will pay 10168 in California state income taxes. You will pay 3 in taxes and have a 62 percent marginal tax rate.

Currently your average tax rate is 32. In addition to income tax there are additional levies such as Medicare. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Virginia State Tax Calculation. Annual Income Monthly Pretax Income Monthly taxes 25 Monthly Post-tax Income. C for every dollar over 180000.

Federal income tax and FICA tax withholding are mandatory so theres no way around them unless your earnings are very low. You will have a marginal tax rate of 41 if you pay 9 in income tax. 37c for every dollar between - 180000.

These amounts are paid by both employees and employers. After taking 12 tax from that 17500 we are left with 2100 of tax. The Medicare tax rate is 145.

There is a 26 percent tax rate on your taxable income. This is particularly useful when comparing the calculation against. How to calculate Federal Tax based on your Monthly Income Simply enter your Monthly earning and click calculate to see a full salary and tax illustration Use the advanced salary calculations to tweak your specific personal exemption and standard deductions View a.

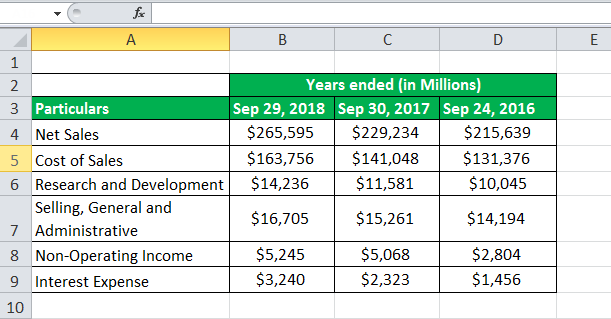

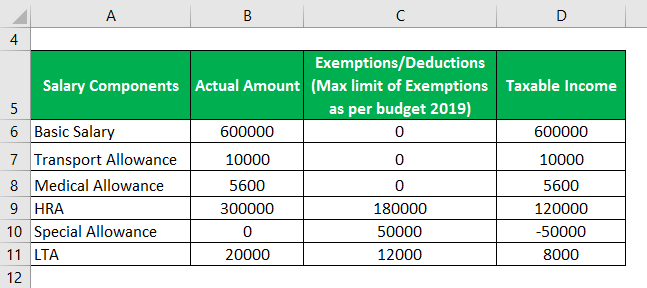

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

Taxable Income Formula Calculator Examples With Excel Template

How Is Taxable Income Calculated

How Is Taxable Income Calculated

Income Tax Calculator India Calculate Your Taxes For Fy 2021 22

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

What Is The Effective Income Tax Paid On Salary Getmoneyrich

How To Save Income Tax On Salary How To Calculate Income Tax On Salary Tax2win

0 Response to "check how much monthly salary is taxed"

Post a Comment